Converting a Gift Certificate Balance

Into a Store Credit

If a customer has a Gift Certificate

and they buy an item that is worth less than the value of the Gift Certificate you can either give

them the difference in cash or you can convert the difference into a Store Credit. These are the steps to

follow for the latter option:

1) Create an entry in the Credits/Charges

Catalog called "Refund Gift Certificate Balance".

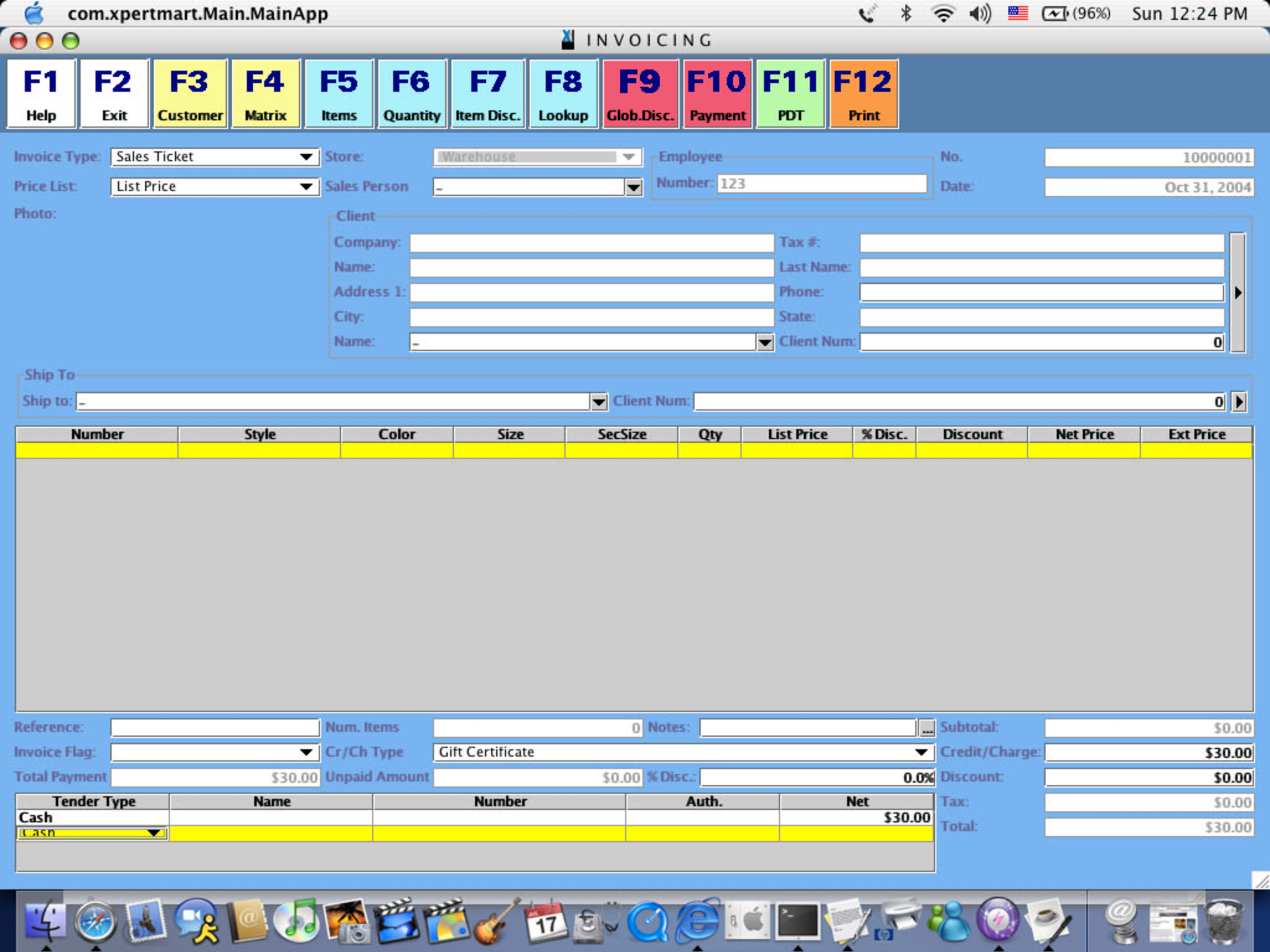

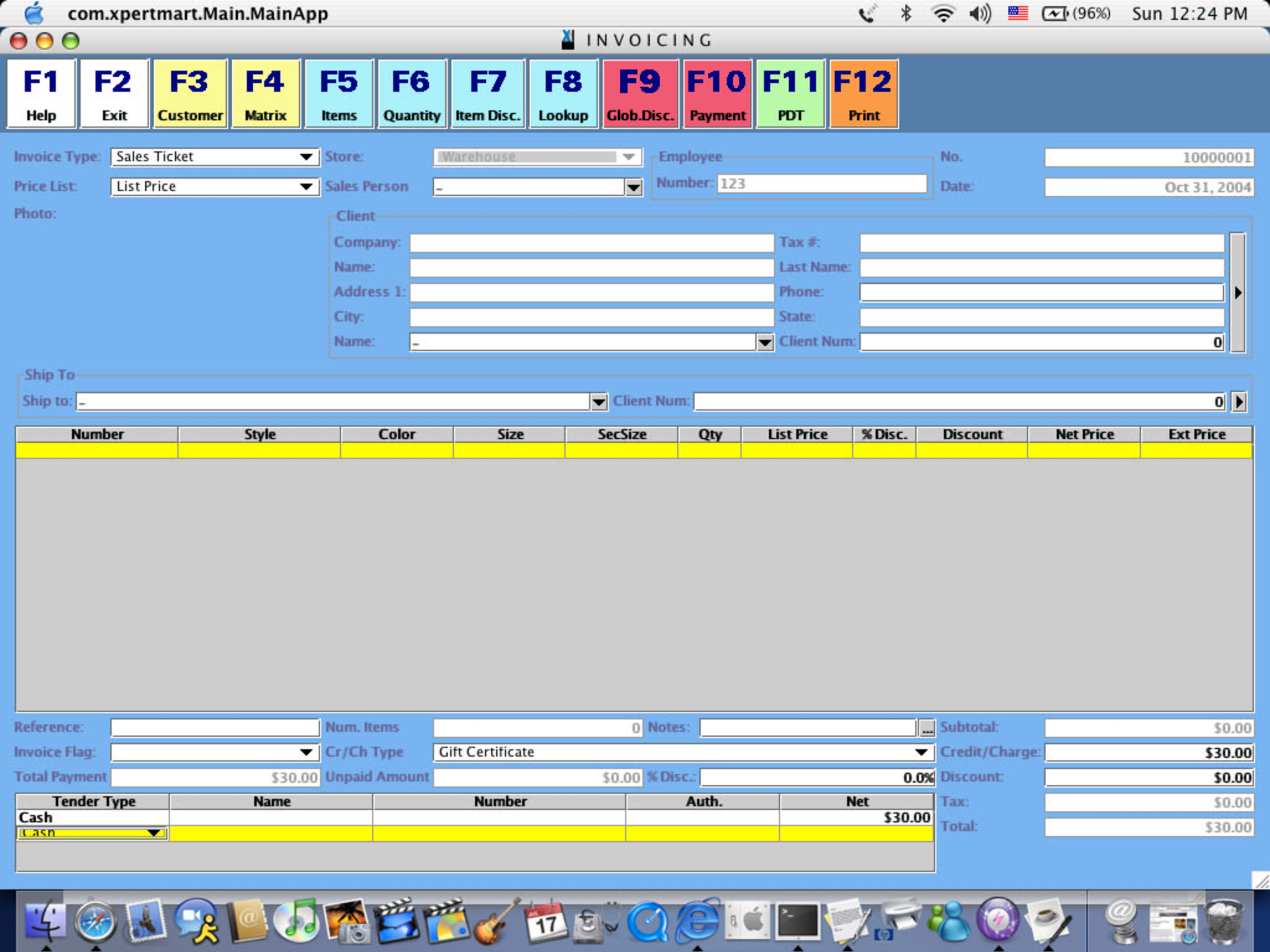

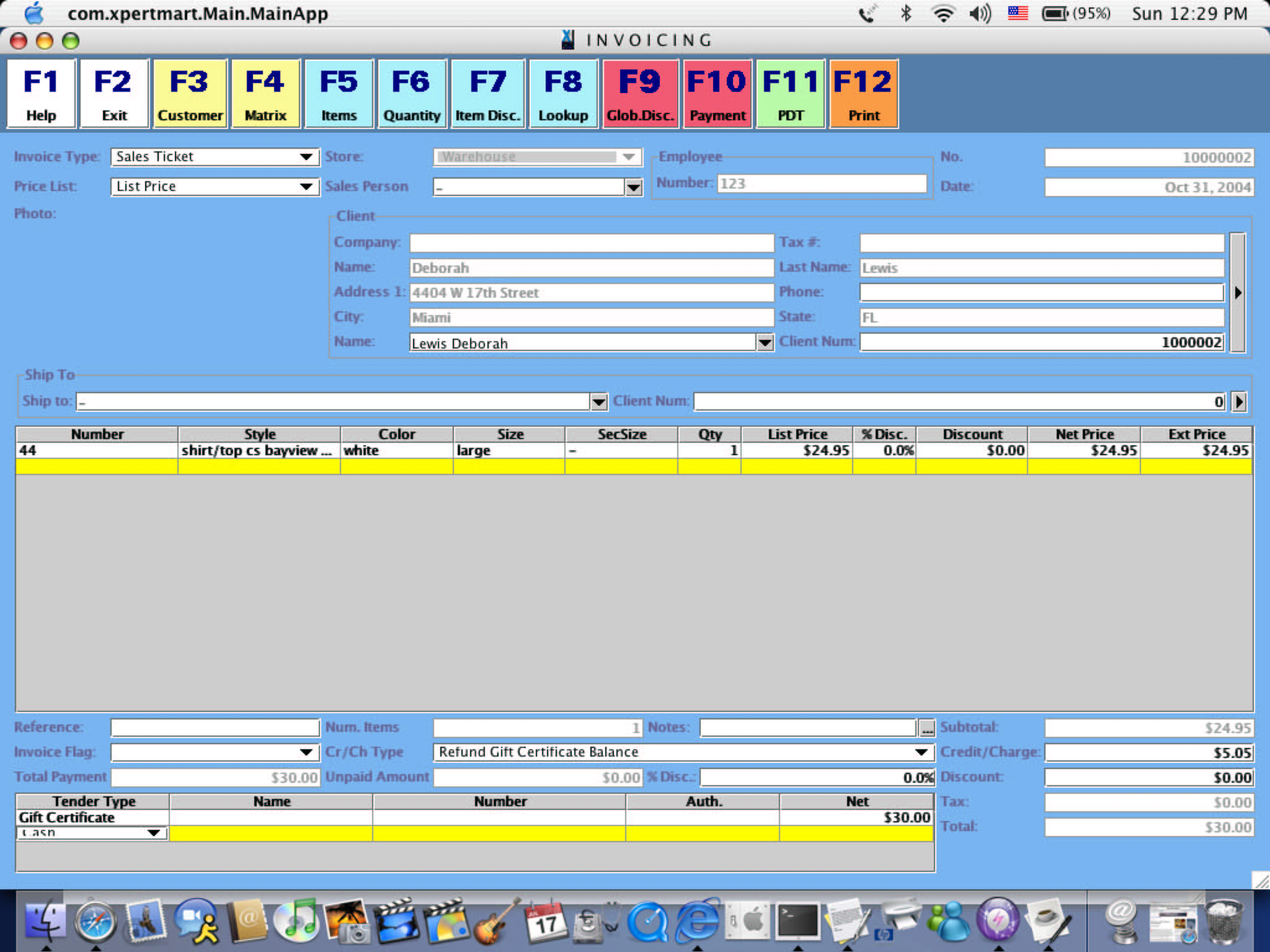

2) When you sell the Gift Certificate, make sure you sell it as a Charge, in the

Cr/Ch Type field at the bottom of the Invoicing

screen. In the example below, a customer is buying a $30 Gift

Certificate.

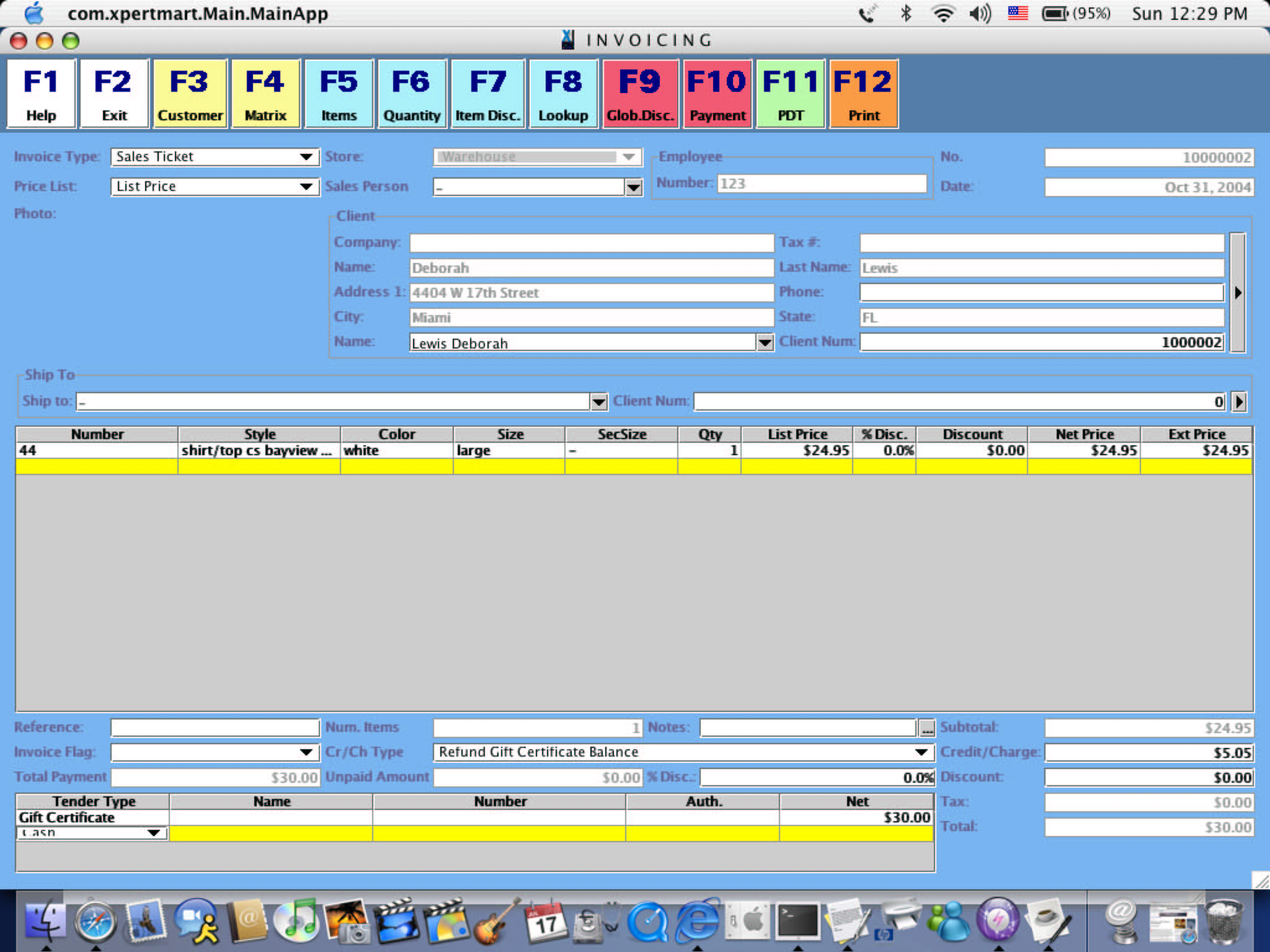

3) When the customer wants to redeem their Gift Certificate, enter the

Item being purchased as you normally would. In the Tender Type area

enter Gift Certificate as the Tender Type and enter the face value of

the Gift Certificate. You will notice that the Unpaid Amount field will

now show a negative amount equal to the difference between the value of

the Gift Certificate and the value of the Item being purchased.

You cannot print the Invoice until the Unpaid Amount is equal to $0.00.

So the next step is to go to the Credits and Charges field and select

"Refund Gift Certificate Balance" from the drop-down menu. In the

amount field to the right, enter the unpaid amount as a positive

number. This way the Item total added to the Charges total equals the

value of the Gift Certificate.

In the example below, the customer is using a $30.00 Gift Certificate

to buy a $24.95 Item. The difference ($5.05) appears as a Charge and

the total tendered is $30.00.

By doing this, the Payments Journal report will accurately show that a

$30 Gift Certificate was used (and not for $24.95).

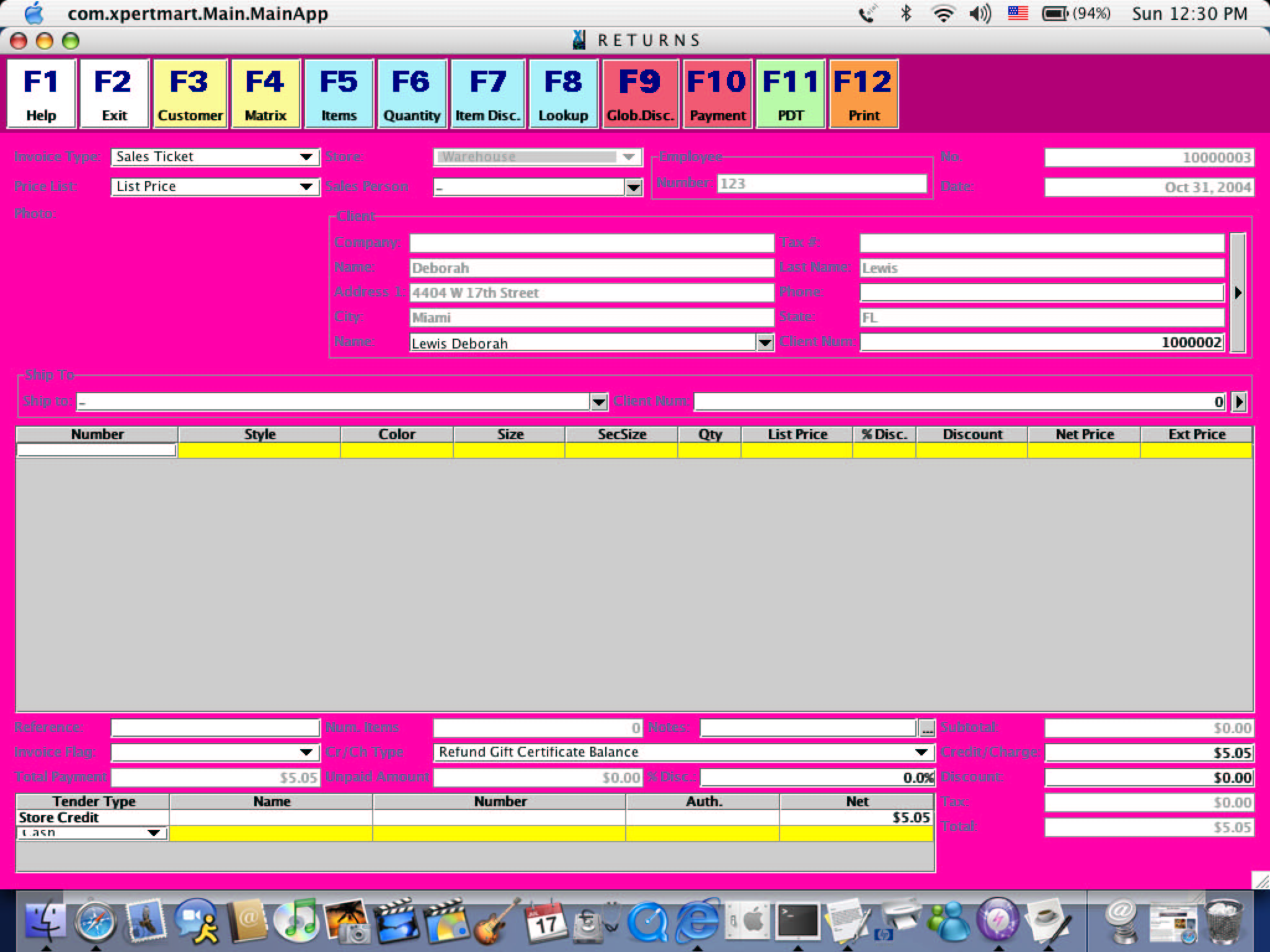

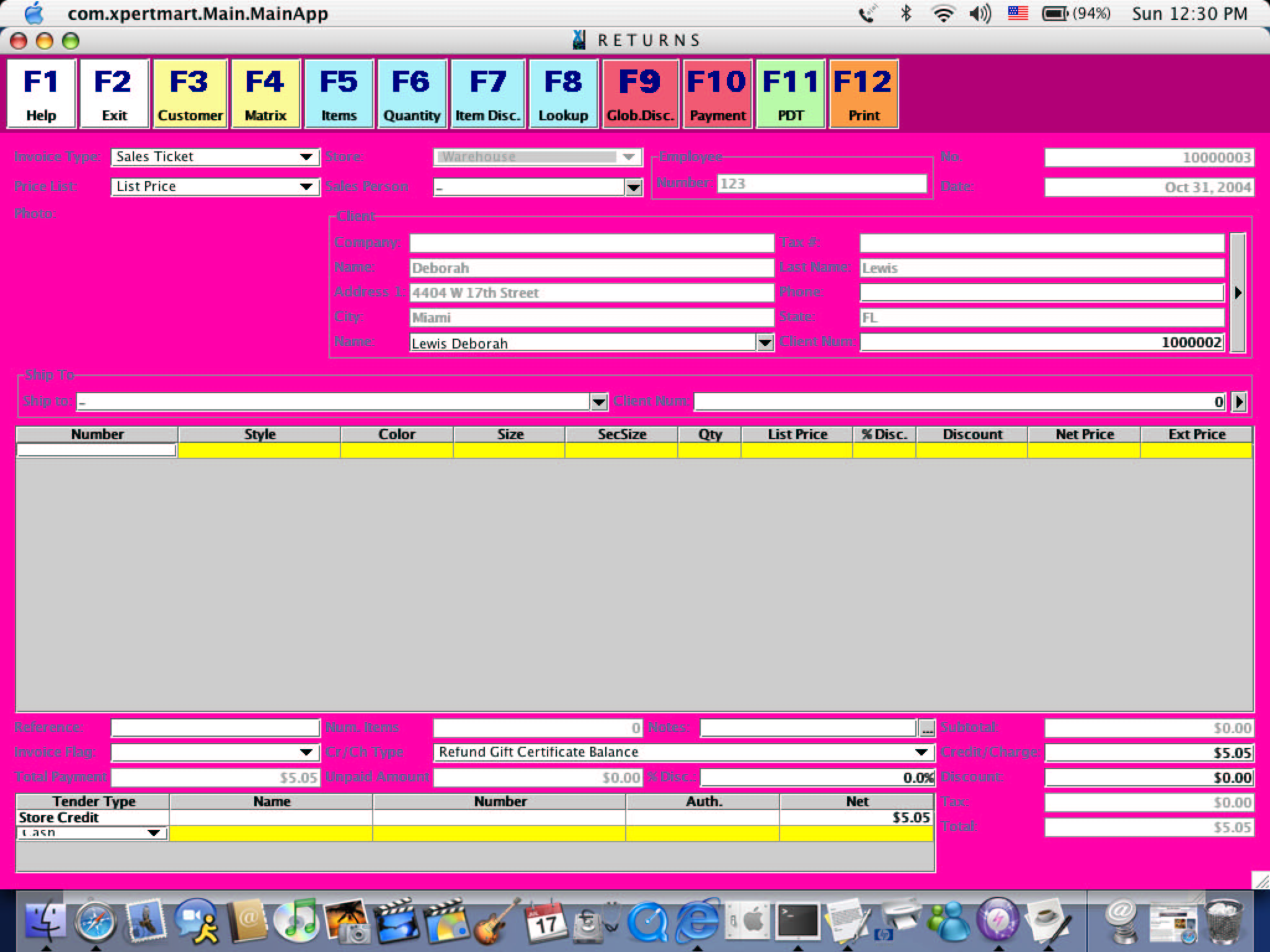

4) To convert the balance of the Gift Certificate into a Store Credit,

the next step is to open a Returns screen. In the Cr/Ch Type field once

again select "Refund Gift Certificate Balance" from the drop-down menu.

Enter the exact same amount as you entered before. (Recall that any

quantity or number entered into a Returns screen is equivalent to

entering that amount as a negative in an Invoicing screen). This way

the Refund Gift Certificate Balance charge type will net out to $0.00.

In the Tender Type field, select Store Credit. The amount will now be

credited to the customer. In the example below the customer is

receiving a Store Credit for $5.95, the balance of the Gift Certificate

left from the last transaction.

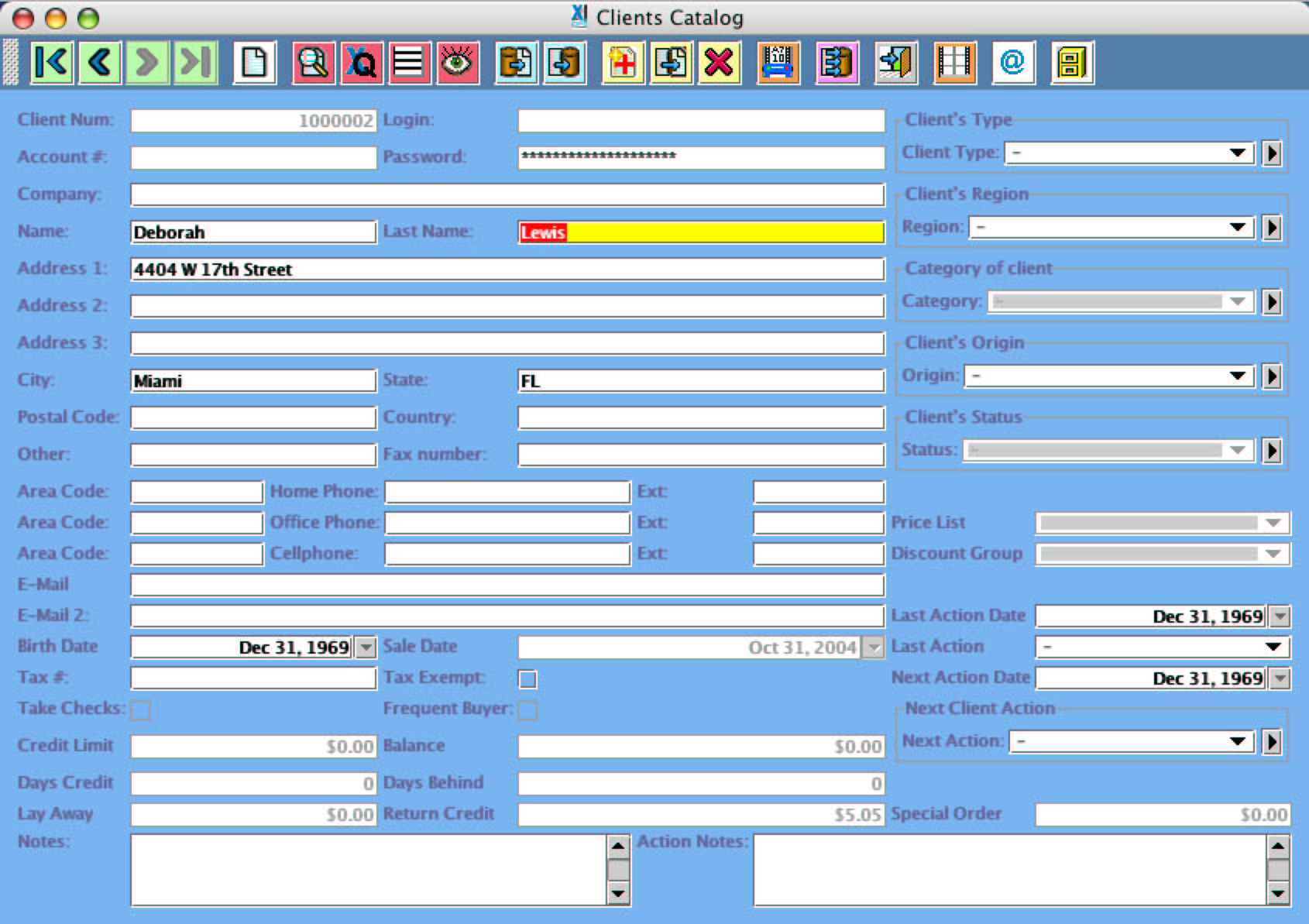

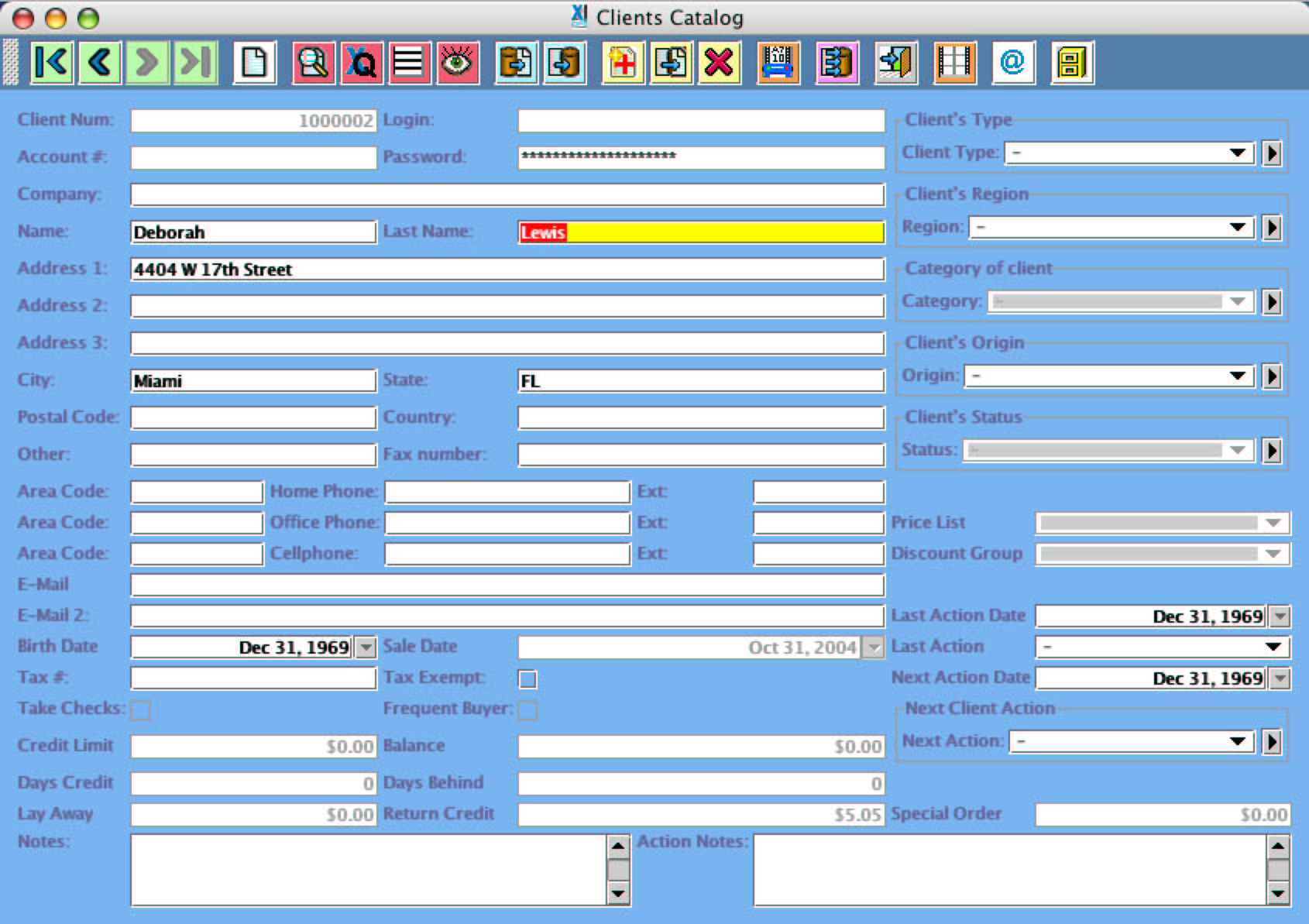

5) You can always open the Clients Catalog

and confirm that the

customer has been properly credited:

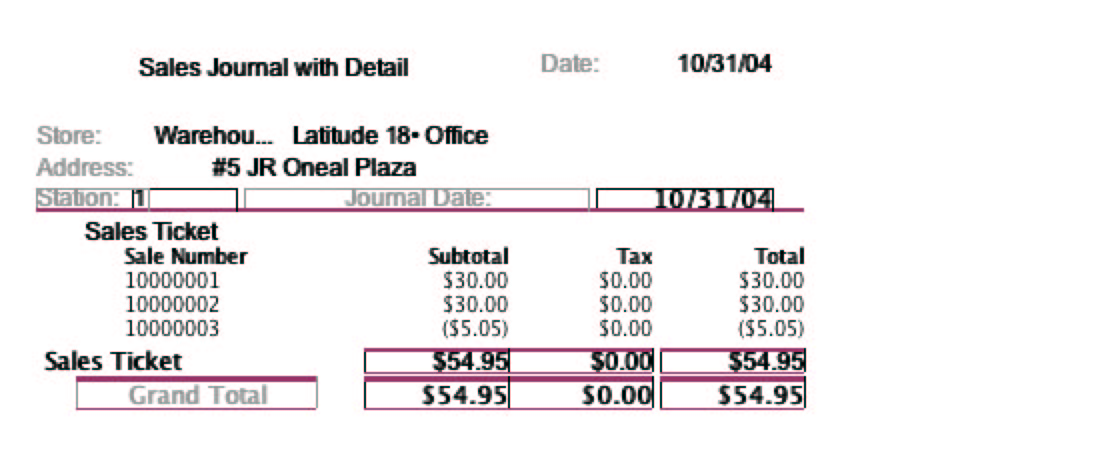

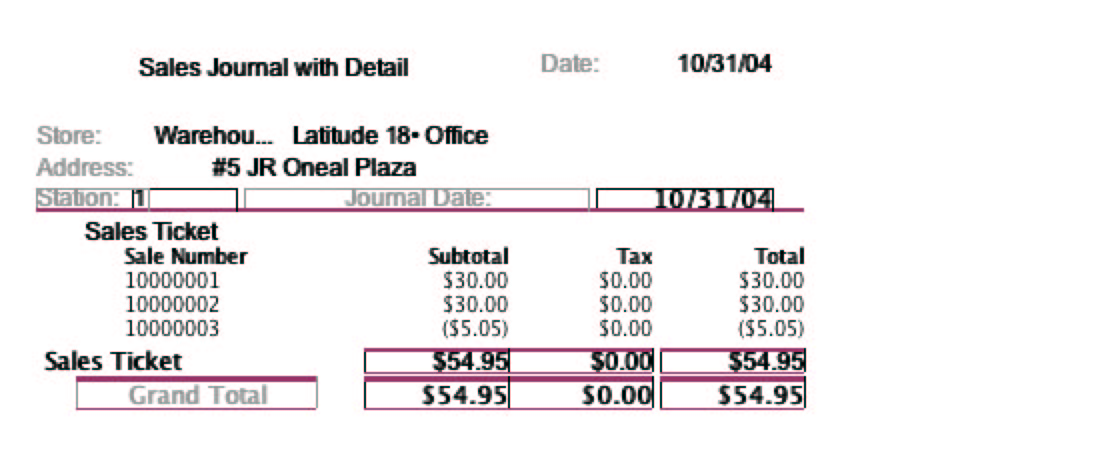

Now let's look at how these three transactions impact our end of day POS reports. The Sales Journal

looks like this:

The Sales Journal shows all three transactions. The Sales Journal is

showing us all activity that ocurred during the day, not how items were

paid for. So we can see there was $54.95 worth of activity since one

customer bought a $30.00 gift certificate and a second customer bought

an item worth $24.95 and has a store credit of$ 5.05.

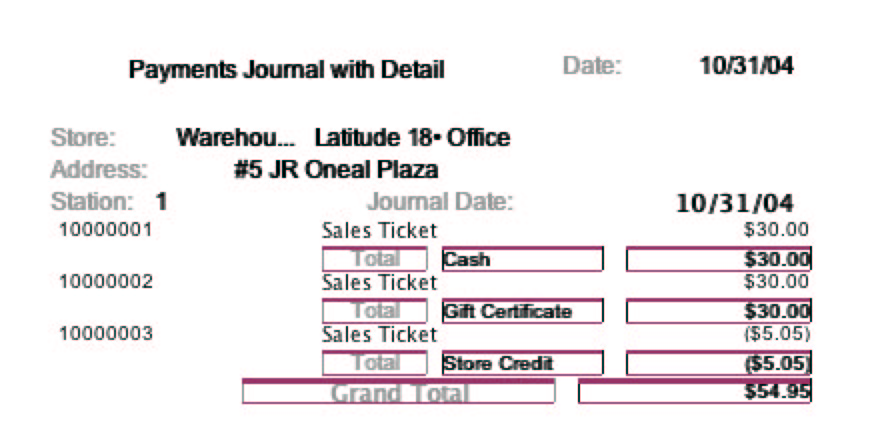

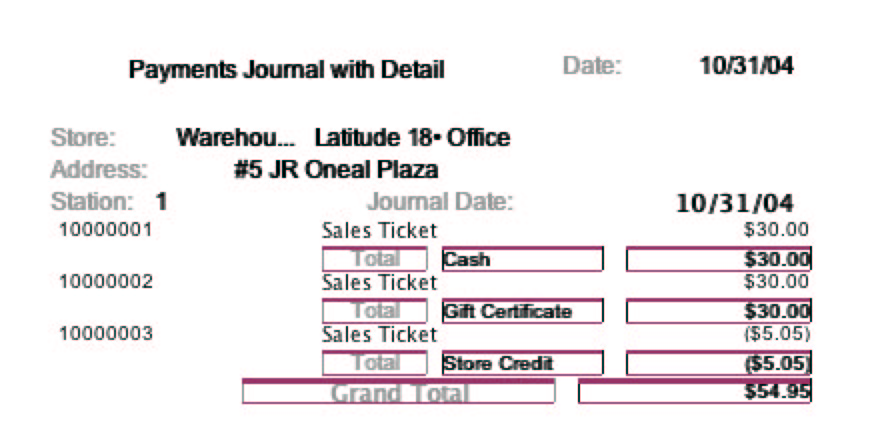

Now let's look at the Payments Journal. The purpose of this report is

to show the payment types that were used during the day. We can see

that each of the three transactions used a different payment type:

This report can appear confusing since the total is $54.95. One might

expect that the report should total $24.95, but that depends on your

perspective. The net total amount you earned for the day is certainly

not $54.95, it is $24.95. However, the purpose of this report is to

show all the ways that money changed hands, even if the same money

changed hands more than once (as it does with a Gift Certificate). At

the end of the day your cash drawer will in fact have $30 in cash as

well as a $30 gift certificate. So the point of the Payments Journal is

not to net these out to show your "earnings" but rather to help you

balance your cash drawer.

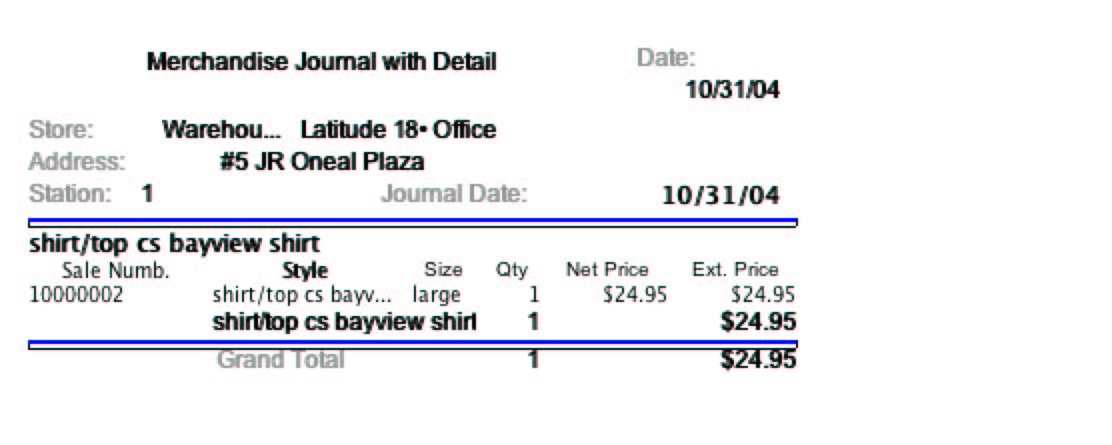

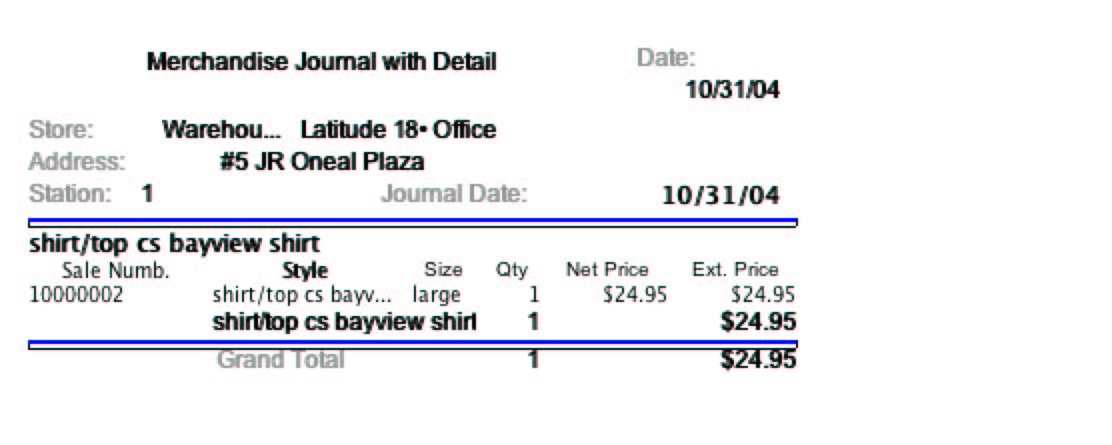

To see the real value of your sales for the day you need to run the

Merchandise Journal which looks like this:

The Merchandise Journal correctly shows that $24.95 worth of

merchandise have been sold. So as this example illustrates, when

looking at a report it is important to always keep in mind what the

purpose of the report is and how that information relates to that found

in other reports to truly get a global perspective.

Copyright © 2004 Dinari Systems LLC