Gift Certificates

Chapter Topics

Credits/Charges in a Transaction

Credits/Charges Catalog

Issuing Gift Certificates as Charge on Invoice

Issuing Gift Certificates as Tender Type

Redeeming Gift Certificates as Credit on Invoice

Redeeming Gift Certificates as Tender Type

There are three different ways to issue and redeem Gift Certificates in

XpertMart (tm). In this document we will explain each of these ways of

handling Gift Certificates. This will allow you pick the handling that

best fits your needs.

The three ways of handling Gift Certificates are:

1 - Issue Gift Certificates as a Charge on an invoice and redeem Gift Certificates as a tender type.

2 - Issue Gift Certificates as a Charge on an invoice and redeem Gift Certificates as a Credit on an invoice.

3 - Issue Gift Certificates as a tender type and redeem Gift Certificates as a tender type.

Credits/Charges

in a Transaction

The Credits/Charges field in the Invoicing

screen is used to add a charge or credit to the customer's total

sale that is not itself an item from your Items

Catalog. The Credits/Charges field allows you to use XpertMart™

as a "cash register" and take or give the customer money without

subtracting merchandise from your inventory. The Credits/Charges field

is very flexible as it lets you enter any amount (unlike the Items detail area where the price

is "pulled" from the Items Catalog).

Examples of charges you may need to add to a sale are: shipping,

alterations and gift wrapping. An example of a credit given to a

customer might be a trade-in of an older item. Any credits or charges

you enter into the Credits/Charges field will show up in your daily Payments Journal reports but will

generally not show up in your sales analysis reports (since they are

not regular merchandise that you sell).

One of the ways to issue a Gift Certificate in XpertMart™

is through the Credits/Charges field.

Credits

Charges Catalog

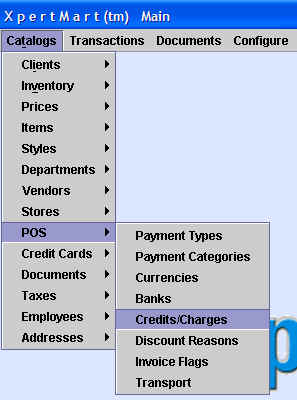

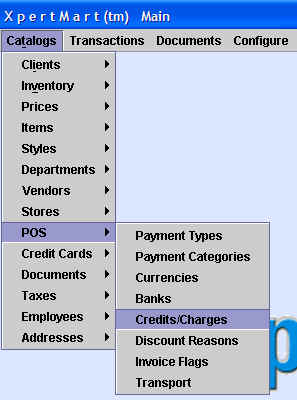

To use the Credits/Charges field in the Invoicing screen you first have

to define which credits and charges will appear in the drop-down menu.

You do this by populating the Credits Charges catalog which is found by

going to Catalogs>POS>Credits/Charges:

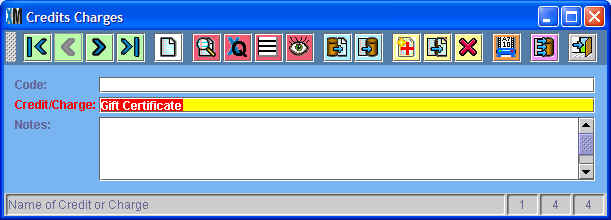

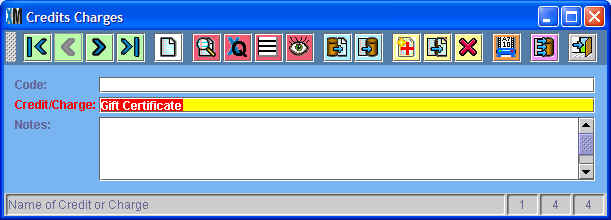

Once the Credits Charges catalog opens up, add an entry for each type

of charge and credit that you plan on use. Make sure you create an

entry for Gift Certificates, as shown below:

Issue Gift Certificates as a Charge on an invoice and redeem Gift Certificates as a tender type.

First we explain how to issue a Gift Certificate as a charge and then futher down how to redeem a Gift Certificate as a tender type.

Issuing

Gift Certificates as a Charge

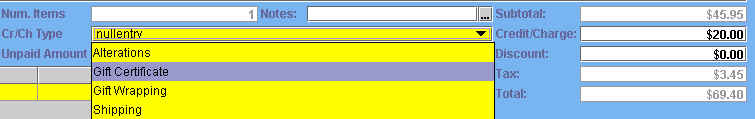

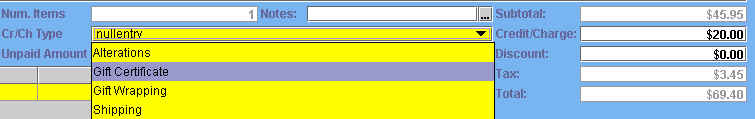

When a customer buys a gift certificate, select Gift Certificate from

the Cr/Ch Type drop-down menu. Enter the amount of the gift certificate

in the Credit/Charge field. In the example below the customer is buying

a $20 gift certificate.

You will notice that the amount entered in the Credit/Charge field is

added to the Subtotal yielding a new Total amount. The Credit/Charge

will appear on the customer's sales ticket.

The Gift Certificate charge can be added to an Invoice that contains

items or you can ring it up on its own without any items on the invoice.

Note: XpertMart™ itself will not print a

Gift Certificate and there is no way for the system to know whether a

gift certificate being redeemed is authentic. Therefore, you should

have gift certicates printed professionally that are difficult to

falsify.

The advantage of issuing Gift Certificates as Invoice Charges is that

sales are not double counted as merchandise sales. Suppose a cusotmer buys a $50 gift

certificate for his wife. A week later the wife buys a $50 garment

using the gift certificate. If you follow the steps outlined above,

your merchandise journal reports will show that you sold $50 worth of

merchandise, not $100. Likewise sales reports run looking at invoice subtotals will not include gift certificates.

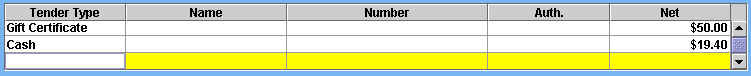

Redeeming

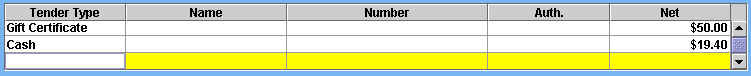

Gift Certificates as a Tender Type

When a customer is ready to redeem the gift certificate they can use it

as a Tender Type. Gift

Certificates can be used as the only tender type or in combination with

other tender types such as cash and credit card.

If the customer is buying an item whose value is less than the gift

certificate then you could give them change using cash or as a Store

Credit (see the next chapter

to learn how).

Issue Gift Certificates as a Charge on an invoice and redeem Gift Certificates as a Credit on an invoice

To issue Gift Certificates as a Charge on an invoice follow the steps mentioned above.

Redeeming

Gift Certificates as a Credit

When a customer presents a gift certificate to apply towards a purchase, select Gift Certificate from

the Cr/Ch Type drop-down menu. Enter the amount of the gift certificate

as a negative number in the Credit/Charge field. In the example below the customer is applying

a $20 gift certificate to the purchase.

You will notice that the amount entered in the Credit/Charge field is

subtracted from the Subtotal yielding a new Total amount. The

Credit/Charge

will appear on the customer's sales ticket.

Issue Gift Certificates as a tender type and redeem Gift Certificates as a tender type

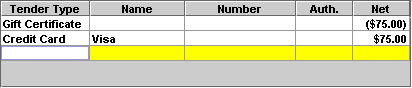

Issuing

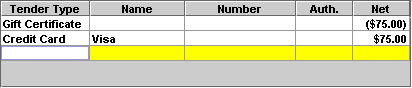

Gift Certificates as a Tender Type

When a customer buys a gift certificate you can register it

as a Tender Type.

You select Gift

Certificates from the tender type menu and enter the amount of the Gift

Certificate you are selling as a negative amount. Then select the

tender type the customer will use to pay for the gift certificate. In

the example below you can see that a Gift Certificate was sold with a

value of $75 and entered as negative -75.

You can combine the sale of a Gift Certificate as a tender

type with a sale of merchandise if you wish. The total to pay

would be the total for the merchandise sold plus the amount of the gift

certificate.

To redeem a Gift Certificate as a tender type follow the instructions given above.

The advantage of issuing Gift Certificates as tender type and redeeming

Gift Certificates as a tender type is that neither the issuing or the

redeeming will affect the subtotal or total of the invoice.

Copyright © 2009 Techsoft Inc.