Chapter Topics

When to Make a Cost Adjustment

How to Make a Cost Adjustment

When to Make a Cost Adjustment

The Cost Adjustment is a transaction that can only be done at the

Main station. A Cost Adjustment lets

you set a new Inventory Cost for an

Item regardless of that Item's Order Cost

or prevailing Inventory Cost. In addition to being able to make a Cost Adjustment

manually by opening the Transactions>Cost Adjustment screen, Cost Adjustments

are also generated automatically whenever you use the Mass Changes to Prices and Costs tool

to modify a cost.

Cost Adjustments should be used sparringly since tampering with your costs

will change your profit margins--the single clearest indicator of the health

of your business and its component parts. By the same token, when you configure

the Security system, only a select few such as

the owners and general managers of the retail enterprise should have the

authority to change costs.

Cost Adjustments are usually necessary under two circumstances: 1) when

Receipts have not been made for merchandise that

has already been sold, and 2) the user has done such a poor job capturing

costs when making Receipts that it is better to wipe the board clean and

begin averaging costs again. Obviously either one of these reasons is indicative

of an operational failure in your retail enterprise. If XpertMart™ is being used properly you will rarely have to make use

of this transaction. (Which is yet another reason to restrictive the use

of Cost Adjustments: they can become an easy way brush sloppy bookkeeping

under the carpet).

How to Make a Cost Adjustment

The Cost Adjustment screen looks a lot like any other transaction

screen. Refer to the Transactions topic before

reading the rest of this chapter which covers only those elements specific

to Cost Adjustments.

Enter the item(s) whose Inventory Cost

you want to adjust into the Items Area

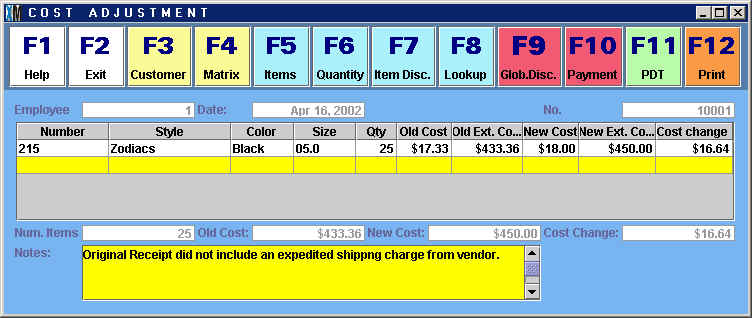

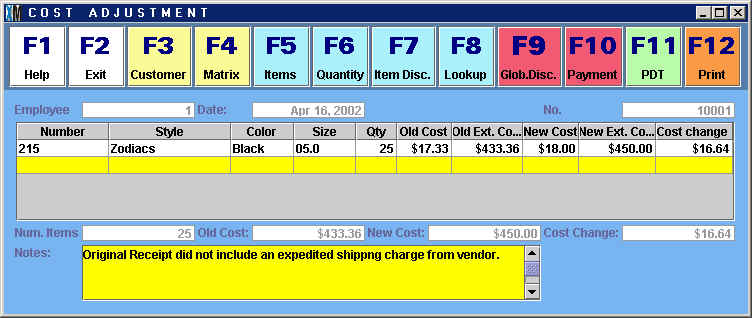

of the transaction screen. In the example below, the user is adjusting the

Inventory Cost of Item #215, the Black, Size 5.0 Zodiac platform mule.

In the "Quantity" column you will see the number or pieces currently in stock,

25 in this case. The "Old Cost" column displays the prevailing Inventory Cost for that item, i.e. the

moving average of Net Costs on Receipts to date.

The "Old Extended Cost" column multiplies the Old Cost by the Quantity. None

of these fields can be edited.

Enter the cost you want to assign to the item into the New Cost field.

The amount you enter here will become the new Inventory Cost for the item and overwrite

the old one when you press <F12>. The "New Extended Cost"

column shows you how much it is costing you to keep these pieces of merchandise

in stock as it multiplies the New Cost by the Quantity.

The "Cost Change" column shows you the net difference between the Old Extended Cost and the New Extended Cost. A positive number indicates an increase in the cost of the item (and by extension a decrease in your profit) and vice-versa. In the example above, the user has changed the old Inventory Cost for this item from $17.33 to a new Inventory Cost of $18.00. Since he has 25 of these Zodiacs in stock, the Cost Adjustment is effectively costing him $16.64.

Keeping with our Philosophy of Control, every time you create a Cost Adjustment a new entry is made into the Cost Audit Log. The example below shows that the Cost Adjustment made on April 16th set the new Inventory Cost to $18.00.

Copyright © 2002 XpertMart